- OneStream Community

- Forums

- Workflow and Data Integration

- Group overlays - looking for brilliant solutions!

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Group overlays - looking for brilliant solutions!

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

2 weeks ago

Hi everyone,

I wanted to reach out to the community to see if others have a slicker way of dealing with head office overlays….

Here’s how we are currently doing things:

Sites/business units complete their year-end workflows as normal, importing their TBs and adding the usual supplementary data (eg. balance sheet roll-forwards, ageing analysis, statutory disclosures etc, etc).

The site-level workflows are then certified and locked to prevent any changes being made.

Consolidated numbers are then reviewed at a group level to see how it’s all looking.

Following this the group tax team reviews the numbers and then decides on tax overlays and adjustments that they want to make.

We deal with this by having a separate workflow set up called “Tax_Overlays”. This workflow has NO assigned entities but it has the “Can load to unrelated entities” property set to True so that any entities can be adjusted in this one workflow.

(As a slight tangent, not really related to this question, but for completeness, we have a separate workflow channel set up for tax UD4 members such that only this Tax_Overlay workflow can load to specific tax UD4 members).

So here is the problem/question – when it is time for the tax team to load their tax overlay numbers, because the Tax_Overlay workflow doesn’t actually have any entities assigned to it and because all the other workflows will have been certified by this point, someone in the group finance team has to manually un-certify and unlock all the workflows which contain entities that the tax team want to load to as otherwise it’s impossible to load in via the Tax_Overlay workflow due to entities being locked. Furthermore in each of the site workflows we need to unlock the Import step and one of the forms steps in order to put numbers into the Import and Forms origins.

Doing the unlocking of all the different workflows is time-consuming and doesn’t feel very efficient. Also during the time while the adjustments are being posted by the tax team, we leave the normal site worfklows unlocked with the risk that a user could go in and change numbers which doesn’t feel great from a control perspective.

Is there a better way?

So…. What do other companies do? Is our process very inefficient? Is there a better way? I had considered having a separate scenario called Actual_Tax where tax overlays could be posted without having to unlock the normal workflows but it seems a bit overkill to do it this way. Also we would end up having to certify a load of blank workflows at year-end and every month going forward.

Does anyone have a slick solution they can tell me about? I am presuming most companies have some sort of tax or other overlay process that happens after the main site submissions go in so I was keen to understand how they do it.

Thanks in advance!

Richard

- Labels:

-

Workflow

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

2 weeks ago

@Richard_Mayo - Here we Go!

When you are setting the unrelated entities to true then you are opening for all the entities to load. So I would recommed to use WF channel.

1. You can Set WF Channel with combination of UD's & Account dimension or just UD's

2. Create a Tax_Overlay as import step vs separate WF Profile. This way you can control the load using entity assignment and also tag the WF channel. It will be independent from your TB load, ex- When you lock the import step then tax will not be locked and still available for load. It can be controlled by WF security for accessing the group.

3. Step 2 will be applicable for Forms and ADJ as well.

Note: In OS there are multiple ways to solution it. One of the way to create a separate WF Profile and you utilize the entity Mapping to control the entity load. BTW if you create another scenario Type then you have to copy the data between the scenario's and it is more maintenance. Hope this helps.

Krishna

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

2 weeks ago

Hi Krishna,

Thanks so much for your quick and detailed response!

Could I check a couple of things to ensure I've understood your suggestion:

So I would include a second import step in each of the "normal" workflows, and this second import step would be set to the "tax" workflow channels so it's differentiated from the standard import step - is that what you had in mind?

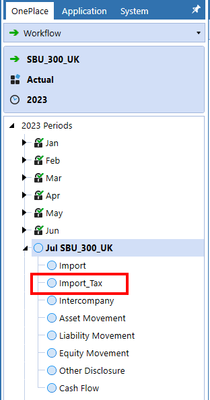

ie. a bit like the following screenshot where the first import step is the normal import and the second one is the tax import (the latter set to the tax workflow channel to keep separate from the first).

If that is the case could you just confirm how this would work in practice - wouldn't we still have the same issue of having to unlock/uncertify many "normal" workflows in order to utilise this additional import step? Also, would this methodology mean that the tax department would continue to load all their numbers in batch to a central workflow?

I do like the idea of having it contained in a workflow which can reference assigned entities as that would give us more control but I'm just not quite understanding how it would make the overall process easier. I am very interested to hear your thoughts!

Thanks for taking the time to share your ideas.

Regards,

Richard

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

2 weeks ago

@Richard_Mayo - Yes the screenshot is correct. You will have two WF Import one for Normal Import and other one for Tax. Each has its own WF Channel. You can set the WF name either Import/Load or you can include Certify process. Now if you lock the import step it will not lock your Tax Import Step because of the WF Channel.

Krishna